Introduction

In a first-of-its-kind release for the insurance industry, Socotra and Amazon Web Services (AWS) have collaborated to publish a fully audited software performance test, as detailed in a recent white paper. While published performance results are common throughout the broader software industry, this marks a groundbreaking moment for insurance technology.

AWS, the world’s leading cloud provider, powers such organizations as Netflix and Toyota1, making it an ideal partner for this project. Socotra has a longstanding partnership with AWS.

Why Performance Matters for Today’s Insurers

As insurers adopt innovative ways to distribute products and meet customer needs, performance has become more critical than ever.

In every case above, external stakeholders are now exposed to the performance and reliability of insurers’ core systems. Traditional IT vendors are not prepared for this level of exposure, and it shows in the systems they’re delivering.

Performance concepts like latency, uptime, and throughput are commonplace in the broader software industry, and there are well-established practices for delivering high-performance cloud. Anyone using online email or search has experienced high performance cloud platforms.

Test Methodology

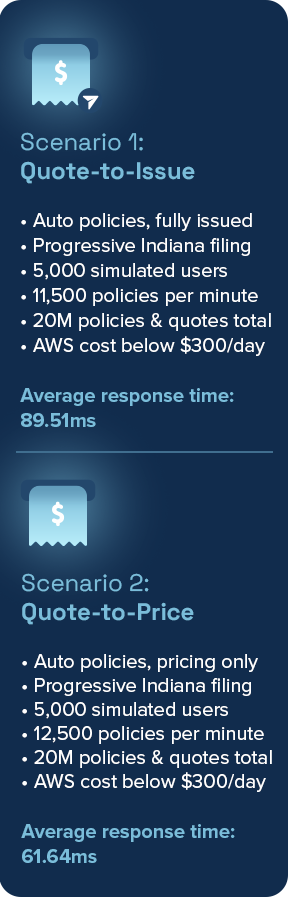

AWS and Socotra conducted two test scenarios to evaluate performance:

Quote-to-issue: Initial account creation and validation, followed by quote creation and subsequent progression all the way to issuance.

Quote-to-price: Initial account creation and validation, followed by quote creation and progression to pricing, but without issuing the policy.

Both scenarios were executed in Socotra’s typical production environment with multiple runs to validate results and identify any outliers. Each run consisted of 15 minutes of constant load, with additional time allocated for ramping up and down concurrent users.

Scenario 1 Load: 11,500 quote-to-issue transactions per minute

Both scenarios were created using a typical personal automobile product configuration from a recent Progressive Auto filing in the state of Indiana. The system was pre-loaded with over 20 million quotes and policies. All policies were randomly generated with between one and three vehicle exposures, one to three drivers, and annual mileage ranging from 10,000 to 120,000. The tests simulated a gradual, uninterrupted increase in concurrent user count from 1,000 to 5,000.

The scenarios isolated tests for many common actions, including account create, account validate, quote create, quote validate, quote price, quote underwrite, quote accept, and quote issue.

AWS monitored and confirmed the accuracy of all tests.

Test Results

The test results were remarkable, showcasing Socotra’s ability to scale to the quality standards of common consumer websites.

Scenario One: Quote-to-Issue

In this scenario, Socotra handled 11,500 policies per minute with 5,000 concurrent users. Impressively, 95% of API requests in the quote-to-issue flow were completed in under 300 milliseconds (ms), demonstrating consistently fast performance for each transaction type.

Scenario Two: Quote-to-Price (“Comparative Rater”)

In the quote-to-price scenario, Socotra achieved a rate of 12,500 quote pricings per minute with 5,000 concurrent users. Here, 95% of API requests were completed in less than 250 milliseconds (ms). This consistent performance exhibited minimal increase in response times even under higher loads.

Autoscaling

Insurance is relatively new to the cloud, and much so-called “cloud” software in the industry is merely ported versions of existing systems. This approach misses the true benefits of the cloud. True cloud includes features such as continual upgrades and high reliability. Another key advantage of modern cloud infrastructure is autoscaling.

As previously described, these performance tests gradually ramped the load to 5,000 concurrent users. During this process, the system autoscaled to handle the increased load. Although performance dipped slightly during the autoscaling process, it quickly stabilized and improved at the higher scale. As shown in the white paper, autoscaling appears as a brief period of slower performance, which immediately recovers to performance faster than before the autoscaling occurred.

This is possible because Socotra consists of numerous microservices running redundantly. The redundancy allows Socotra to achieve high reliability (see “Reliability” section below), and also allows for high performance because parallelized services can easily scale up simply by adding more instances. Modern cloud providers automate this process, and Socotra leverages this automation to its advantage.

Reliability

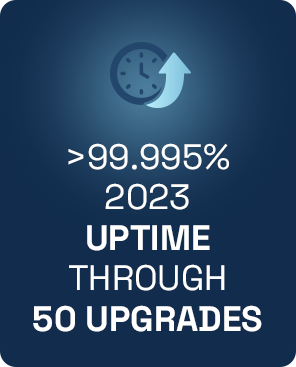

Of course, performance only matters if the system is actually operational. Reliability matters. Socotra recently highlighted this in a recent blog post announcing the company’s 2023 uptime stats:

These results clearly demonstrate how Socotra is setting new standards for performance and reliability. The collaboration with AWS highlights the potential for insurers to leverage advanced cloud technologies to meet modern performance expectations. We anticipate further innovations as Socotra continues to drive the industry forward, using proven practices to elevate insurance technology for both insurers and end customers.

1 https://aws.amazon.com/solutions/case-studies/

2 https://risk.lexisnexis.com/about-us/press-room/press-release/20240221-q4-demand-meter

3 https://www.insurancethoughtleadership.com/ecosystems/whats-next-embedded-insurance

4 https://www.insurancethoughtleadership.com/customer-experience/lowering-costs-customer-acquisition