Purchasing a new insurance core platform is a high-risk, high-cost investment. Even after sales demos and 600-line RFPs, insurance companies can’t be sure that the hundreds of thousands (sometimes millions) of dollars they’re about to spend on new technology will be worth it. In the end, insurers might find themselves locked into a contract with technology that just isn’t right for their project or business goals.

To verify that they’ll see a worthwhile return on their investment, insurers (and the vendors that sell to them) must de-risk the decision process by conducting valuable POCs. As we’ve discussed before, valuable POCs are more than a pitch deck and feature demo—they produce something functional and relevant. They show how a new platform can reduce complexity and efficiently tackle the scope of an insurer’s projects.

Socotra has worked with some of the world’s largest insurers to conduct valuable POCs that de-risk this critical business decision by bridging knowledge gaps and demonstrating practical value:

OBJECTIVE: EVALUATE NEW BUSINESS AND RATING MODELS

- Background: To reach millennials around the U.S., Nationwide decided to develop a digital-first personal auto insurance product that streamlined the overall insurance purchasing experience.

- Valuable POC: In early 2019, Nationwide ran a POC with Socotra to test whether our platform would be able to develop a product that could produce simple and quick quotes via a user-friendly interface. The POC resulted in a product that fit Nationwide’s needs, and the company partnered with Socotra to release Nationwide Spire a few months later.

OBJECTIVE: DRIVE DOWN TCO

- Background: Mutual of Omaha, a Fortune 500 mutual insurance and financial services company, recognized the benefits of shifting from legacy systems to modern technology in order to deliver better customer experiences and reduce the total cost of ownership.

- Valuable POC: Mutual of Omaha partnered with Socotra to move their policy operations to the cloud and develop their first (and most complex) cloud-based insurance product: Disability Income. The POC proved the hypothesis that starting with the most difficult product would make it much faster and easier to configure and deploy additional lines of business that followed. The POC also proved that a modern, cloud-based policy admin system can significantly drive down operating costs.

OBJECTIVE: EXPAND DISTRIBUTION CHANNELS

- Background: Symetra, a large life insurer based in the Pacific Northwest, saw consumer purchasing habits begin to shift toward digital channels. The company decided to develop a digital insurance product to keep pace with modern needs.

- Valuable POC: In early 2020, Symetra ran a POC with Socotra to prototype expansion into new customer acquisition channels. The success of the POC convinced Symetra to sign on as a customer and continue to work with the Socotra team to configure and model the new digital product. The project is on track for going live.

OBJECTIVE: INTEGRATE NEW TECHNOLOGIES AND DATA SOURCES

- Background: MS Amlin, a U.K.-based insurer, wanted to digitize its products to appeal to small and medium-sized enterprise clients across Europe, but its existing legacy platform couldn’t move quickly enough.

- Valuable POC: In 2020, the company conducted a POC with Socotra to weld together two products—a low-code frontend (Mendix) and a robust core backend system—to enable speed to market. Socotra’s open and secure APIs allowed MS Amlin to leverage new data sources and technologies to build advanced solutions that met customer needs via a no-code application.

Getting signal for your policy admin evaluation process

How can you tell whether a core platform will work for your needs? Conducting a valuable POC gives an insurer insight into whether the tech is right for them, and if they decide it isn’t, they won’t have wasted excessive amounts of time and money figuring that out. In 2020, Socotra conducted a POC for a large auto insurer in the U.K. to model their personal auto insurance product and connect it to their internal APIs. Though the company didn’t ultimately choose Socotra, the POC provided value by helping them to understand what kind of platform would be the right fit for their product.

De-risking core transformation starts here

Valuable POCs give insurers a chance to validate their ideas on a high-value platform in a low-risk, low-cost environment. Socotra’s POCs are designed with experimentation in mind to mitigate the risk of introducing new products and technologies or expanding into new distribution channels or business models:

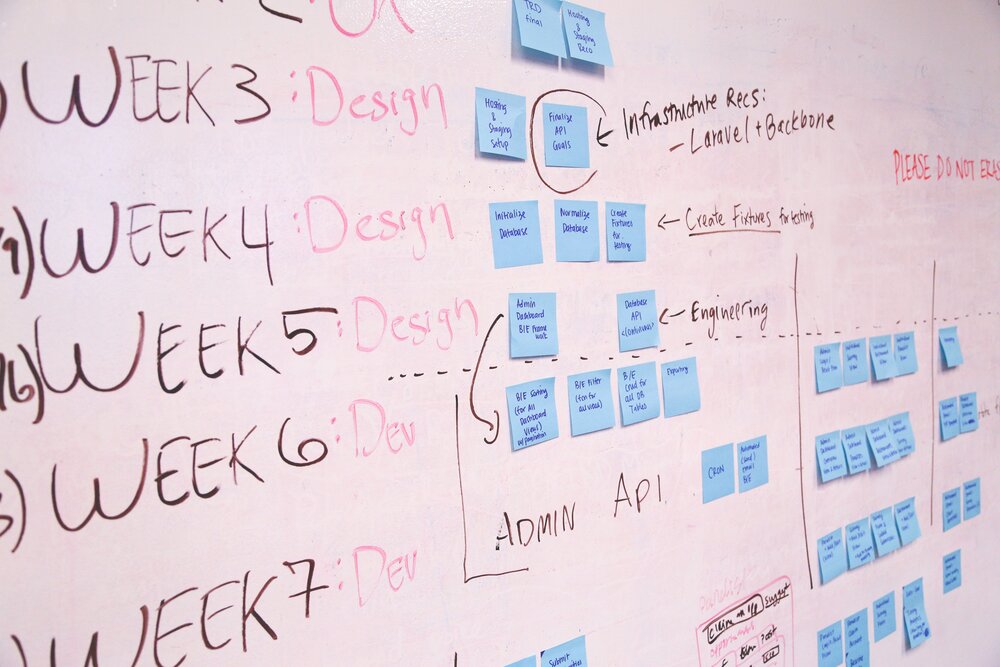

- We use short sprints to break down complex tasks, so our POCs often identify hidden complexities.

- We provide valuable insights during the product development process that allow insurers to reassess or refine their development strategy and validate scope.

- Our POCs always result in functional prototypes that can quickly and easily be deployed as full products.

- By keeping our POCs small and agile, insurers can test many different ideas and finalize prototypes more quickly.

Our cloud-native platform, open APIs, and public documentation have laid the foundation for dozens of unique insurance products, with more on the way in 2021.

See if Socotra is the right fit for your business by signing up for our low-risk, two-week Virtual Proof of Concept Program or a 30-day free trial.