Socotra Recognized for Achievements in Making Insurance Application Innovation Faster, Easier and More Agile

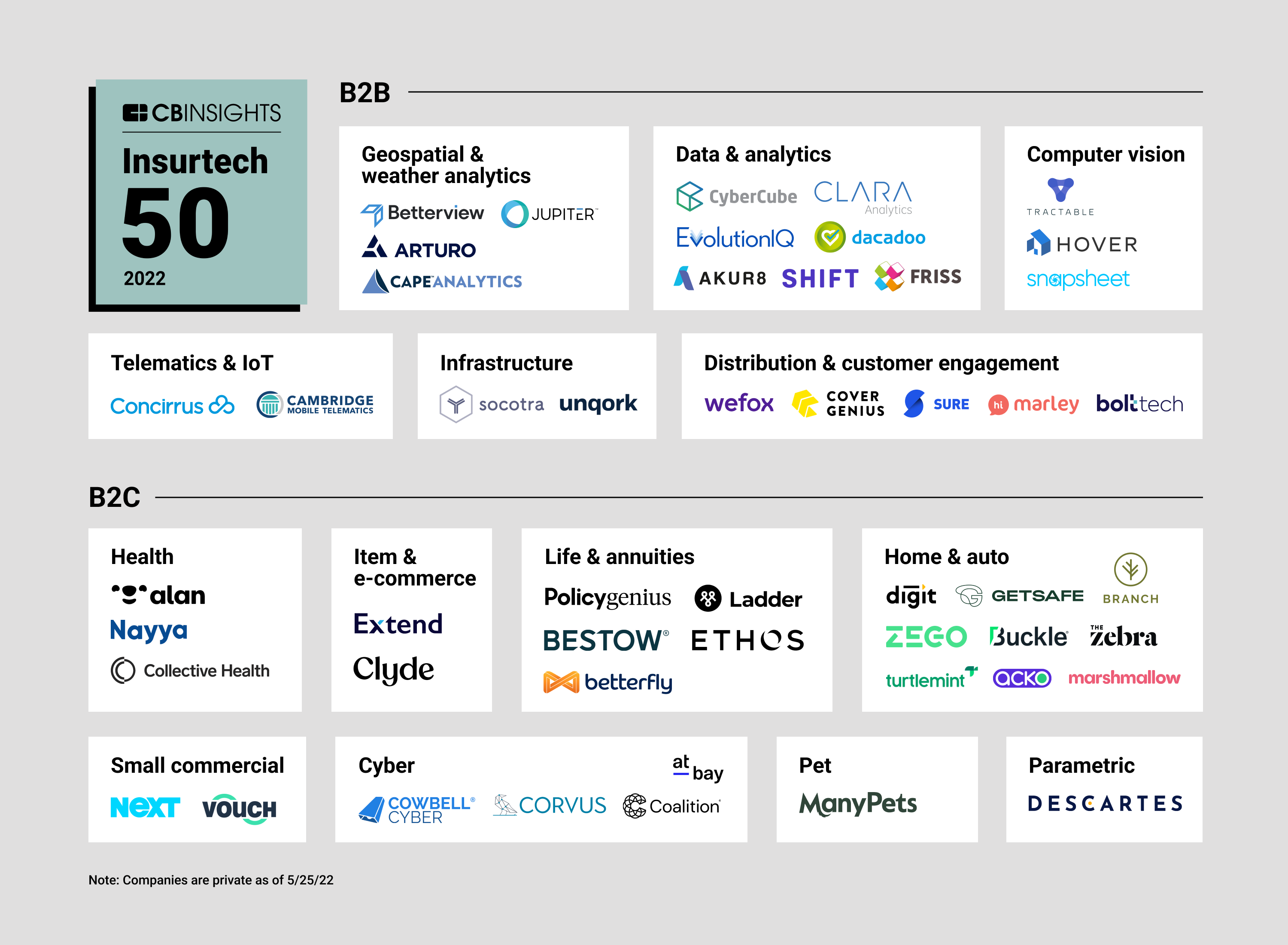

CB Insights today named Socotra to its first annual Insurtech 50, which showcases the 50 most promising private insurtech companies across the globe.

The 2022 Insurtech 50 cohort has raised over $11B from approximately 400 disclosed investors, across 215 equity deals, since 2017 (as of 6/10/22). In 2021 alone, companies from this cohort raised over $5.5B across 55 deals.

“The companies in our inaugural Insurtech 50 have built and harnessed new technologies to improve all aspects of the insurance value chain, from customer acquisition to underwriting and claims for a variety of different insurance products,” said Brian Lee, SVP of CB Insights’ Intelligence Unit. “Together they are accelerating innovation across an industry that directly impacts human health and well-being.”

“Socotra is delighted to be recognized by CB Insights in the inaugural Insurtech 50 as one of the world’s 50 most promising private insurtech companies,” said Dan Woods, founder and CEO, Socotra. “Socotra is unique in offering a proven and truly modern front-to-back platform for quickly launching and iterating insurance products. This advanced technology empowers insurers and MGAs to gain business agility, accelerate innovation, and reduce costs.”

Using the CB Insights platform, the research team picked these 50 private market vendors from a pool of over 2,000 companies, including applicants and nominees. They were chosen based on factors including R&D activity, proprietary Mosaic scores, market potential, business relationships, investor profile, news sentiment analysis, competitive landscape, team strength, and tech novelty. The research team also reviewed hundreds of Analyst Briefings submitted by applicants.

Founded in 2014, Socotra provides the insurance industry’s most open and agile platform powerful enough for today’s innovators, adding 24 new insurtech customers in the last 18 months alone. After raising a $50 million Series C funding round in March 2022 and the acquisition of Avolanta in May 2022, the company is now expanding its platform and ecosystem capabilities, including Socotra Marketplace—the insurance industry’s first no-code app marketplace enabling instant integrations with third-party technology providers. With Socotra, insurers can bring innovative products to market with out-of-the-box capabilities or by integrating through open APIs any custom or third-party technology in the insurance ecosystem, such as a proprietary rating engine, a digital frontend experience, or an automated claims solution.

For those wanting to learn more about the Insurtech 50 and the selection process, please register for the webinar, Behind the Scenes of the Insurtech 50, on June 15, 2022 at 2:00 pm EST.

2022 Insurtech 50 Investment Highlights

- Global representation: This year’s winners represent ten different countries across the globe. Thirty-one of the selected companies are headquartered in the US. The United Kingdom came in second with five winners, followed closely by France with four winners and India with three. Other countries home to a winner/winners on this year’s list include Germany, the Netherlands, Switzerland, Singapore, Chile, and Australia.

- Early-stage Innovation: Fourteen of the winners are Series A or Series B companies with promising product ideas, from accelerating claims management to creating parametric insurance for climate change-related perils.

- Unicorns: This year’s list includes twenty unicorns with a $1B+ valuation.

About CB Insights

CB Insights builds software that enables the world’s best companies to discover, understand, and make technology decisions with confidence. By marrying data, expert insights, and work management tools, clients manage their end-to-end technology decision-making process on CB Insights. To learn more, please visit www.cbinsights.com.