By Matt Hamilton, Product Architect at Socotra

Effective billing management is more than just a necessity for insurers—it’s a key driver of customer satisfaction and business growth. However, for many insurers, it’s also a source of enormous costs and headaches.

Over the last decade, the team at Socotra has worked with many insurers and learned about the challenges they’ve faced with previous billing systems. In response, we built Socotra Billing, the most powerful and flexible billing platform designed to improve billing operations, enhance customer experiences, and increase financial integrity and visibility.

In this blog, we’ll first review the pitfalls of many existing billing systems. Then, we’ll discuss the four elements needed for better billing, and how Socotra delivers on these elements.

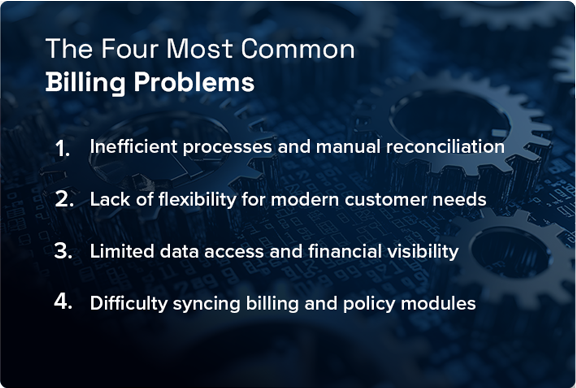

To build the ultimate billing system, it was first necessary to understand where previous billing systems have fallen short. Here we discuss four problems we’ve repeatedly heard from our customers.

Problem #1

Inefficient Processes and Manual Reconciliation

Most billing systems force insurers to manually audit and reconcile billings against policy transactions. This leads to massive inefficiencies and increased risk of errors for accounting teams. Mismatches—such as billings not aligned with scheduled premiums or payments that don’t match existing invoices—may even require ongoing manual reconciliations for the entire length of a policy, which could be years.

Problem #2

Lack of Flexibility for Modern Customer Needs

The most common interaction between insurers and customers is billing, which makes it crucial to customer satisfaction. Customers want choices for how they are billed and make payments, the ability to make changes using a self-service portal, and clarity on how billing is impacted before they commit to any potential policy changes.

However, most billing systems have some combination of rigid billing schedules, limited payment options, and few digital capabilities. As a result, customer service representatives and online portals can’t keep up with modern customer needs.

Problem #3

Limited Data Access and Financial Visibility

Accessing detailed billing data is a significant hurdle in most billing systems, preventing insurers from generating reports to answer their business questions and uncover insights. For example, business teams can spot potential cancellations based on how many times a customer has missed a payment; however, most billing systems have difficulty providing this type of information, even with extensive configuration.

Not only that, the quality of data flowing from legacy billing systems to general ledger systems may not provide accounting teams with the level of detail they need to properly audit and maintain compliance. For example, out-of-sequence endorsements and reversals may be inaccurately reflected in the system and require manual reconciliations.

Problem #4

Difficulty Syncing Billing and Policy Modules

Most billing systems require insurers to double their effort when configuring billing and policies. For example, billing schedules need to be set up and continually synchronized in both systems separately, which wastes time and creates potential errors. Some configuration work can even break the integration between billing and policy administration systems.

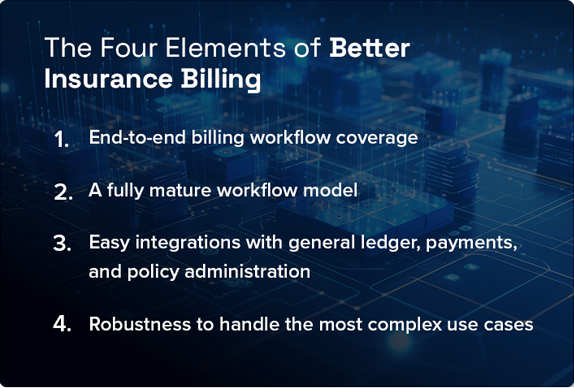

It became clear early in Socotra’s life that the observed problems with billing are merely symptoms of a poorly-designed billing system, or legacy billing–often ported to cloud and falsely called “modern”. With proper design elements, these symptoms are alleviated, and that’s precisely what Socotra has done. Now, let’s break down how Socotra Billing delivers on each of these elements.

Solution Element #1

End-to-End Billing Workflow Coverage

Socotra Billing offers comprehensive workflows that cover every type of billing event with ease. These workflows include:

- Billing Schedule Changes

- Cancellations

- Delinquencies and Grace Periods

- Disbursements

- Invoice Creation

- Invoicing Holds

- Lapsed Coverage

- Late payments

- Overpayments and Underpayments

- Priced and Unpriced Policy Changes

- Quote Generation

- Reinstatements With or Without Gaps

- Renewals

- Reversals

- Temporary Suspensions

- Write-offs

Solution Element #2

A Fully Mature Workflow Model

Not only do workflows accomplish their intended action (e.g. a renewal must actually renew the policy), they must also accomplish it in a way that provides flexibility and transparency. With Socotra Billing, each action is quotable, reversible, reportable, and auditable.

All Transactions Are Quotable

More than simply generating policy quotes, a great billing system can “quote” the financial impact of any action before executing the action. This also means it’s easy to run standalone quotes to validate or test results without impacting the current system.

For example, a customer wants an out-of-sequence endorsement on one policy in a bundle, but they want to know if and how it will change the premium for the other policies in the bundle. Socotra Billing enables a customer service representative to answer this question easily, without needing to execute any actual transactions.

All Transactions Are Reversible

Any action can be rolled back with a full audit trail to all impacted transactions and a feed to downstream systems. Actions can be individually reversed independent of the order in which they occurred (i.e. the ultimate billing system wouldn’t insist on reversing the most recent action first).

That means that a customer can make four consecutive changes to their policy and easily reverse just the second change, if desired. This reversal will automatically flow through to general ledger systems, ensuring that no manual reconciliations are required.

All Transactions Are Reportable

Billing systems should provide real-time data export to financial and reporting systems, so insurers can quickly analyze critical data, make more informed decisions, and unlock new opportunities and revenue-growth strategies.

Socotra Data Lake provides real-time access to high-quality data across every transaction, including pre-built dashboards and high-performance queries. Socotra’s publicly documented and open APIs allow insurers to connect billing data to the rest of their data stack, including Snowflake, AWS Quicksight, Power BI, Tableau, other data platforms, and reporting and analytics suites.

All Transactions Are Auditable

When a policy has multiple changes, most billing systems require manual adjustments that are difficult and time-consuming to track over time. Billing teams can spend excessive resources investigating and validating transactions across accounts or correcting errors because of limited visibility into historical transaction data. This limited auditability can expose insurers to increased regulatory scrutiny and fines for lack of compliance.

With a proper billing system, it’s obvious where every charge came from and why. Every billing action is meticulously tracked, including a complete audit trail for all activities, adjustments, and interactions. This transparency and financial accuracy simplifies compliance and builds trust with customers.

Solution Element #3

Easy Integrations With General Ledger, Payments, and Policy Administration

Insurers must comply with financial regulations and ensure their transactions are accurate and auditable. With a robust double-entry accounting engine as its foundation, Socotra Billing guarantees financial integrity and offers a full audit trail for every activity, adjustment, and interaction. Staff also get a transparent view into the current state of a customer’s billing situation so they can easily navigate customer accounts, from outstanding balances to upcoming invoices, fostering clear communication and reducing confusion.

Socotra Policy and Socotra Billing are independent modules, which gives insurers control and flexible configuration for installments and invoicing. Insurers can completely separate the process of rating of coverages and calculation of premium from the billing and collection of payments.

Configuration can still be done in one place and flow through all modules, reports, and UIs without the need for re-integration or re-configuration of other modules. This stands in stark contrast to legacy technology that limits an insurer’s ability to scale modern billing operations, as configuration and updates are massively time-consuming and resource-intensive.

Downstream systems, like general ledger and data warehouses, are often a source of frustration when it comes to integration. Socotra enables insurers to leverage open APIs to seamlessly integrate Socotra Billing any payment processor or general ledger / accounting system. In particular, Socotra has an extensive partner ecosystem of payment processors, such as FIS, One Inc, Paymentus, Stripe, and Tranzpay. Socotra customers have easily integrated with more than 10 different payment processors.

Solution Element #4

Robustness to Handle the Most Complex Use Cases

One of Socotra Billing’s standout features is its ability to handle complex billing scenarios effortlessly. Its modular design allows for transactions to be executed in any combination or sequence, accommodating a wide range of complex, real-world use cases, including:

Policy Changes After Renewal: Easily adjust billing when a customer requests a change post-renewal, meaning that it needs to be applied to both the remainder of the current term as well as the upcoming term.

Combining Changes: Quickly calculate the impact of multiple policy and billing changes without actually making the changes.

Complex Reversals: Provide clarity when a customer makes a change, and then another, and then asks how reversing the first change would affect their bill.

Underpayments, Overpayments, and Cancellations: Easily assess outstanding balances when a customer underpays or overpays and requests immediate cancellation.

Prospective Out-of-Sequence Changes: Allow customers to understand the effects of a prospective out-of-sequence change on billing without issuing the policy.

Conclusion

Taking the Next Step in Modernizing Your Billing System

Beyond the principles listed above, any SaaS product should be a fundamentally mature piece of software. That means it should provide:

True cloud-native design and performance

100% configuration and 0% customization through code

Continual, free, and zero-downtime upgrades

Full documentation and open APIs

About Matt Hamilton

Matt Hamilton, Product Architect at Socotra, has extensive experience in product management and software development. He spent 10 years at Guidewire Software, where he held progressively senior roles in product management. With an MBA from Stanford and a BA in Mathematics and Computer Science from UC San Diego, he is known for his technical aptitude, having developed skills in numerous programming languages and technologies. A former nuclear submarine officer, he also holds several patents for his innovative work in insurance billing and product data.