It’s time for policy administration software to grow up. Insurers are tired of the same old problems from the same old vendors: Maintenance is expensive, data is inaccessible, digital transformation is nearly impossible, and even the smallest changes take months. These problems start with the core, and the solution starts with the core.

Socotra also has many interfaces for underwriting and policy. Learn more about Socotra interfaces.

Policy administration is the operating system of any insurance company, and Socotra Policy is the first one built like an operating system, resulting in the most powerful, flexible, and mature policy administration platform in the market.

Socotra has made the industry’s largest investment in modern insurance core technology, and it shows in the benefits that Socotra customers experience:

The best support for large-scale insurance, no matter the number of products, policies, or concurrent users

Much faster implementations, integrations, and product updates—all with less system integrator lock-in and the industry’s lowest total cost of ownership (TCO)

Unparalleled data access and control, enabling more data-driven operations

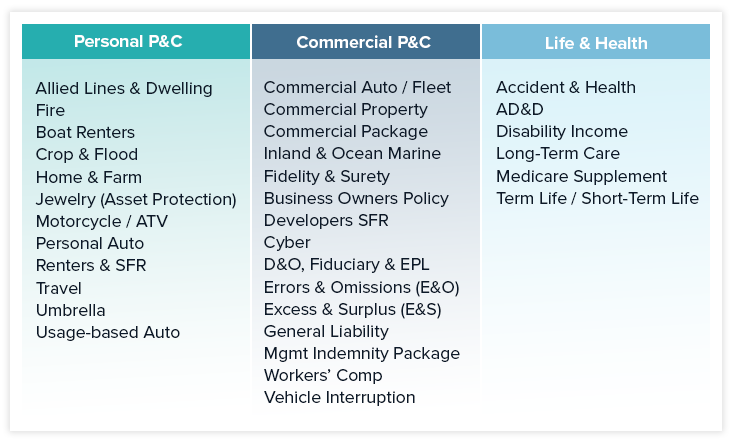

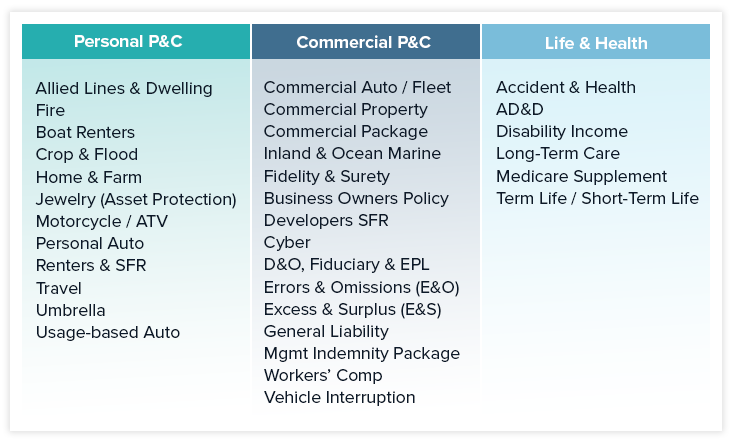

Deploying, maintaining, and scaling insurance products is complex. Socotra makes this easier by offering one platform that can power any insurance product, geography, and distribution channel. Socotra also delivers the industry’s most advanced data model, empowering insurers to build and maintain insurance products with unprecedented flexibility and ease.

In fact, Socotra has been deployed for more than 45 products and successfully prototyped for dozens more, including:

Deploying, maintaining, and scaling insurance products is complex. Socotra makes this easier by offering one platform that can power any insurance product, geography, and distribution channel. Socotra also delivers the industry’s most advanced data model, empowering insurers to build and maintain insurance products with unprecedented flexibility and ease.

In fact, Socotra has been deployed for more than 45 products and successfully prototyped for dozens more, including:

Support any product, geography, regulation, or distribution channel using well-defined, non-custom, and reusable configuration

Use modern devops tools and CI/CD for product development, improving time to market and implementation quality

Configure products graphically or with JSON, a publicly documented and widely used data format that any engineer can use

Manage configuration in one place so that changes automatically flow across Socotra and into downstream systems

Deploy and maintain hundreds of products and product variations simultaneously on a single tenant, with the industry’s only pure-configuration product inheritance

Create product versions that are easy to track and automatically updated across the platform, ensuring policies, documents, and reports are accurately generated—no matter how many times a product changes

Stay on the latest version of Socotra—no matter the product, geography, or distribution channel—with weekly backwards-compatible upgrades with zero disruption

Support any product, geography, regulation, or distribution channel using well-defined, non-custom, and reusable configuration

Use modern devops tools and CI/CD for product development, improving time to market and implementation quality

Configure products graphically or with JSON, a publicly documented and widely used data format that any engineer can use

Manage configuration in one place so that changes automatically flow across Socotra and into downstream systems

Deploy and maintain hundreds of products and product variations simultaneously on a single tenant, with the industry’s only pure-configuration product inheritance

Create product versions that are easy to track and automatically updated across the platform, ensuring policies, documents, and reports are accurately generated—no matter how many times a product changes

Stay on the latest version of Socotra—no matter the product, geography, or distribution channel—with weekly backwards-compatible upgrades with zero disruption

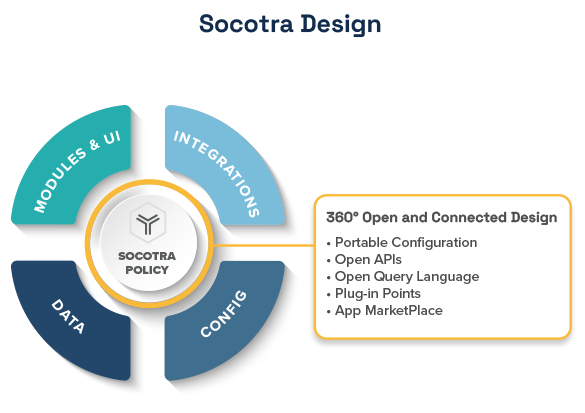

Most policy administration systems market themselves as being “modular” but don’t provide the benefits of a modular system. They still require an army of engineers with specialized training to separate and replace modules, and modules can’t be reused or rearranged after launch.

In contrast, Socotra delivers true modularity for unprecedented scale and maintainability. Socotra’s elegant design makes it the most coherent, understandable, non-redundant, and maintainable core ever developed, connecting via open APIs and plug-in points to any UI, module, or integration an insurer could need. Furthermore, all data in Socotra is readily available via SQL, and Socotra configurations are centralized, open, and intuitive.

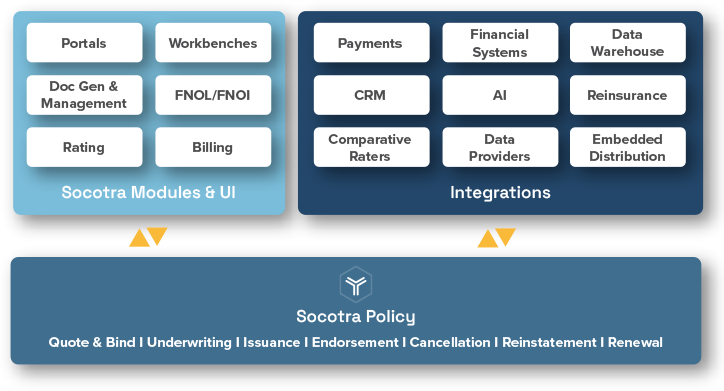

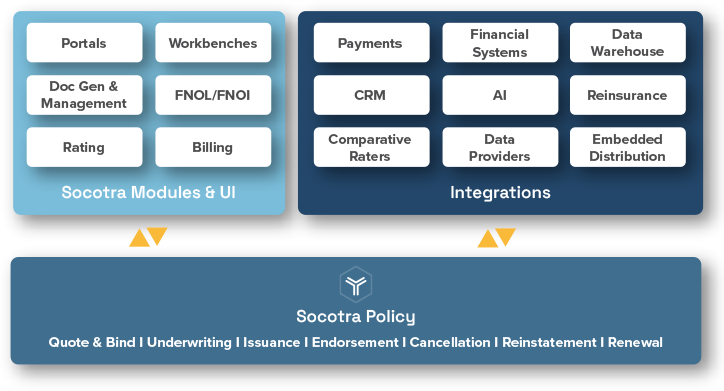

Socotra Policy is a policy administration core with UI and modules for billing, rating, document generation, and more. Modules are easy to add, remove, and swap, as they are 100% open through Socotra’s public APIs. Some even connect as apps through our marketplace.

Learn more about our modern approach to user interfaces and why we have the most powerful and flexible billing platform in the industry.

Socotra’s open APIs and modular design simplify and speed up integrations. Leverage out-of-the-box functionality for nondifferentiators via integrations and focus on building the parts that set your business apart.

Deploying AI and making data-driven decisions require data access, and Socotra’s data accessibility leads the industry. Socotra’s cloud-native, API-first approach allows for seamless integration with advanced analytics and AI capabilities. Users can easily connect their data to other systems, including modern data platforms, such as Snowflake, Databricks, and Azure Data Factory.

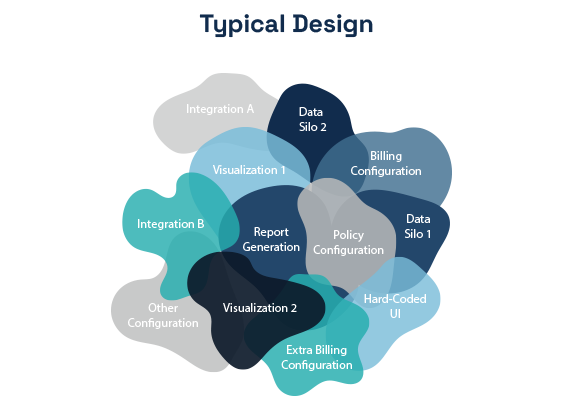

Legacy technology often requires configuration at multiple points in the system, which makes updates time-consuming, resource-intensive, and prone to error.

In contrast, Socotra enables insurers to configure their products in one place. This configuration flows through all modules and reports without the need for re-integration or re-configuration, ensuring accuracy, reducing manual processes, and improving scalability.

Socotra Policy is a policy administration core with UI and modules for billing, rating, document generation, and more. Modules are easy to add, remove, and swap, as they are 100% open through Socotra’s public APIs. Some even connect as apps through our marketplace.

Learn more about our modern approach to user interfaces and why we have the most powerful and flexible billing platform in the industry.

Socotra’s open APIs and modular design simplify and speed up integrations. Leverage out-of-the-box functionality for nondifferentiators via integrations and focus on building the parts that set your business apart.

Deploying AI and making data-driven decisions require data access, and Socotra’s data accessibility leads the industry. Socotra’s cloud-native, API-first approach allows for seamless integration with advanced analytics and AI capabilities. Users can easily connect their data to other systems, including modern data platforms, such as Snowflake, Databricks, and Azure Data Factory.

Legacy technology often requires configuration at multiple points in the system, which makes updates time-consuming, resource-intensive, and prone to error.

In contrast, Socotra enables insurers to configure their products in one place. This configuration flows through all modules and reports without the need for re-integration or re-configuration, ensuring accuracy, reducing manual processes, and improving scalability.

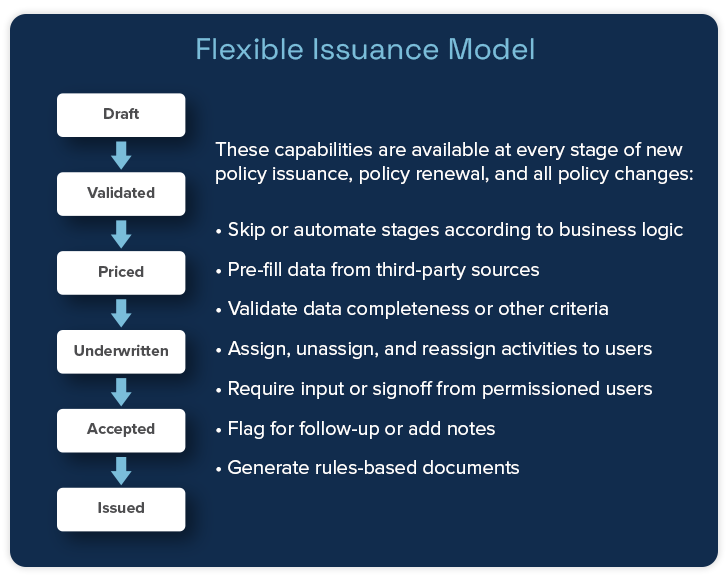

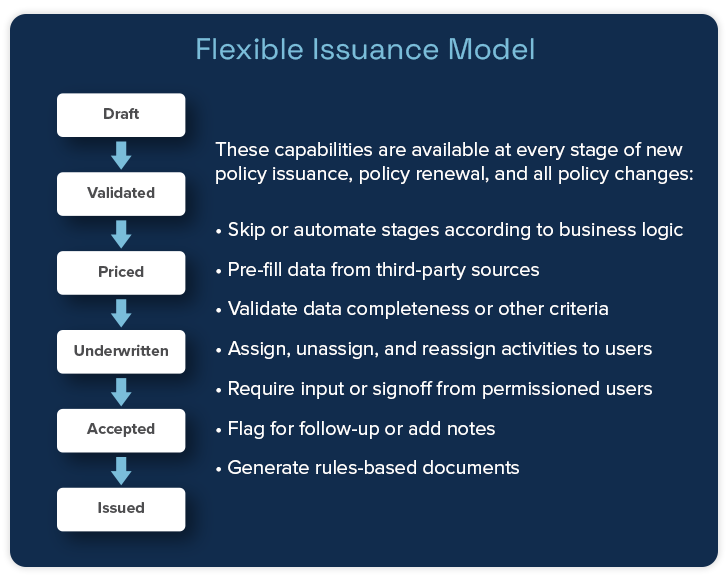

The process of issuing a new policy can be very complex and require specialized workflows, which vary significantly between products and companies. As a result, many insurers feel trapped by their technology, having to choose between building entirely custom systems or altering their business processes suboptimally to match rigid legacy software.

Socotra uniquely solves this problem by providing unparalleled control, while remaining fully productized so no customization is required. With Socotra, insurers can leverage flexible capabilities, integrations, and automations to design a process that meets the needs of their business.

What about renewals and policy changes? These use the same 6-stage model for elegant power and control like no other platform!

The process of issuing a new policy can be very complex and require specialized workflows, which vary significantly between products and companies. As a result, many insurers feel trapped by their technology, having to choose between building entirely custom systems or altering their business processes suboptimally to match rigid legacy software.

Socotra uniquely solves this problem by providing unparalleled control, while remaining fully productized so no customization is required. With Socotra, insurers can leverage flexible capabilities, integrations, and automations to design a process that meets the needs of their business.

What about renewals and policy changes? These use the same 6-stage model for elegant power and control like no other platform!

Once a quote becomes a policy, Socotra enables insurers to manage post-issuance activities. These activities include policy changes, renewals, cancellations, and delinquency management.

Socotra understands these transactions frequently occur in combinations that create problems for many insurers and has addressed them with the most robust transaction model in the industry. Socotra effortlessly handles out-of-sequence and late-term endorsements.

Furthermore all transactions in Socotra can be quoted ahead of execution, and all are reversible. To learn more about the benefits of Socotra’s industry-leading transaction model, read about Socotra Billing.

Once a quote becomes a policy, Socotra enables insurers to manage post-issuance activities. These activities include policy changes, renewals, cancellations, and delinquency management.

Socotra understands these transactions frequently occur in combinations that create problems for many insurers and has addressed them with the most robust transaction model in the industry. Socotra effortlessly handles out-of-sequence and late-term endorsements.

Furthermore all transactions in Socotra can be quoted ahead of execution, and all are reversible. To learn more about the benefits of Socotra’s industry-leading transaction model, read about Socotra Billing.

Head of IAG Satellite

Winner of the Celent Model Insurer Award

READ THE STORY →

Jerry Sayre

Chief Software Engineering Officer, Mutual of Omaha

READ THE STORY →

Chief Operating Officer, MS Amlin

READ THE STORY →