by Dan Woods, Founder and CEO

Socotra is the modern core platform helping to accelerate the insurance industry’s transformation.

A ubiquitous industry under pressure

Can you imagine what the world would be like without a lifeline like insurance? Insurance provides critical help to people at their most vulnerable moments. When a disaster strikes a modernized country, the help provided by FEMA or international aid is utterly dwarfed by the help provided by insurance.

In the past decade, the world has been reshaped by technology, and with it, new risks to be covered have emerged. Alongside those new risks, customer preferences have evolved drastically. Customers want better user experiences, transparent pricing, highly-tailored products, and digital purchasing channels. In order to address these new realities, insurers know they must modernize their technology stacks — yet most insurers are still running on legacy systems that are expensive to maintain, slow to run, and create hurdles for innovation.

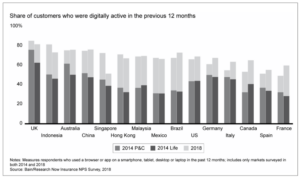

The share of digitally active insurance customers increased on average

by more than 60% in the last four years (Source: Bain)

Modern platforms emerge in other industries

In the last decade, new technology paradigms such as microservices, cloud, and API-driven architecture have enabled other industries to build modern platforms that support one version for all customers (e.g., Salesforce, Google Docs, Asana). But those same paradigms had not made their way to the insurance industry.

This wasn’t shocking — insurance companies have historically lagged behind others when it comes to adopting new technology. But the more I thought about it, the more I realized the immense impact that modern technology could have on insurance. Such an industry having outdated IT is the opportunity of a lifetime to create a big positive impact — one that includes reducing maintenance costs, increasing performance, and accelerating product innovation. The next question was what the next generation would look like.

A core system built for the future

That’s where Socotra comes in — to provide insurers with a modern, enterprise-grade core system that enables them to rapidly develop and distribute products that better serve their customers. With open configuration and APIs empowering insurers to deploy powerful technology with their choice of engineering resources, Socotra helps insurance organizations of all sizes become more agile, move faster, and more able to adapt to current and future industry changes.

Our intuitive platform understands fundamental insurance concepts, meaning insurers can create nearly any type of insurance product imaginable using the platform’s out-of-the-box, publicly documented functionalities. And because all transactions happen in one cohesive data model, insurers only have to configure it once, the data model automatically carries over to modules across the entire policy lifecycle (e.g., underwriting, claims, billing).

In the past, it would take more than a year to configure and launch new products. Today, with Socotra, insurers can create products in a matter of months.

A new chapter for an old industry

Socotra is the first modern, core insurance platform that is agnostic to product, geography, and distribution channel. In our first year, our team developed a flexible architecture that allowed our customers to define and update insurance products with much shorter timelines than the current standard of 24–36 months.

Today, our customers include tier-1 insurers such as AXA, Nationwide, IAG, and Mutual of Omaha. And, we recently announced that we’ve raised $15.2 million in a Series B funding round led by Brewer Lane Ventures with participation from Portag3 Ventures, 8VC, and MS&AD Ventures.

Insurance is one of the oldest industries in existence. Given that its purpose is to assess, manage, and mitigate risk, it’s no surprise that the insurance industry is very deliberate when investing in modernization and core transformation; but when an industry this risk-averse is embracing new technology this fast, something really big is happening!

This is just the beginning of our story. I’m proud of the success our team has had in modernizing the insurance industry — one that is as necessary for a modern economy as electricity and water. Socotra is here to help insurers make the technology leap so they can innovate and grow their business, and we’re excited to be opening up new possibilities for them.

And if you’d like to join us on our journey, we’re hiring.